BMO Real Financial Progress Index shows inflation causing a quarter of Americans to delay retirement

This quarter’s BMO Real Financial Progress Index results found that inflation and rising consumer costs are severely impacting Americans. Nearly 60% of Americans said that inflation has adversely impacted their personal finances, of which about one in four said that they have felt a major impact. As a result of inflation, 36% of Americans have reduced their savings and 21% have reduced their retirement savings. A quarter of Americans will need to delay their retirement. Younger Americans are feeling the most impact – over 60% of those aged 18-34 said they had to reduce contributions to their savings.

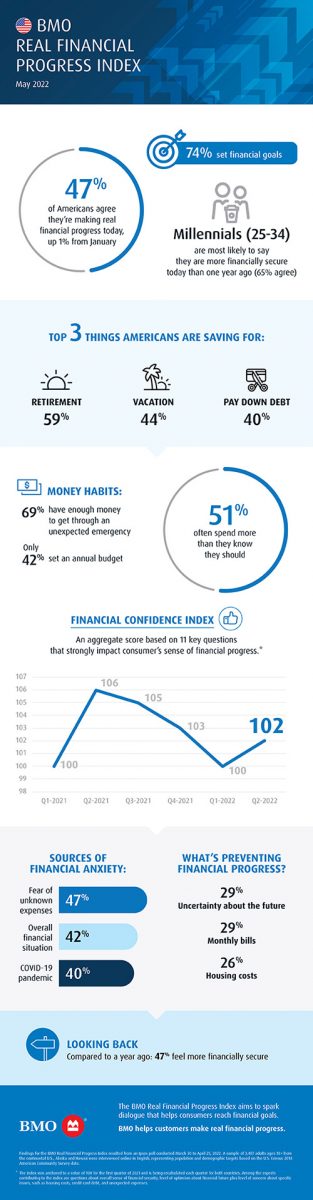

These findings are from the latest BMO Real Financial Progress Index, a quarterly survey conducted by BMO and Ipsos that measures Americans’ sentiment around financial confidence. The survey was conducted from March 30 to April 25, 2022.

How Americans are offsetting increased costs of living

80% of Americans plan to change their actions to offset the impact of inflation and rising costs of everyday essentials:

- 42% of Americans are changing how they shop for groceries. This includes opting for cheaper items, avoiding brand names and buying only the essentials.

- 46% are either dining out less or consciously spending less when dining out.

- 31% are driving less to offset the soaring cost of gas.

- 23% are spending less on vacations or canceling them altogether.

- 22% are taking measures such as canceling subscriptions to the gym, cable, etc.

Women are more likely to make lifestyle changes than men

Nearly half of women plan to adjust the way they shop for groceries (47% vs. 36% men), dine out less (49% vs. 43% for men), and 25% of females plan to cancel subscriptions vs. 20% of men.

“Prices across the board – from cars and gasoline to groceries and other everyday essentials – are rising at the fastest pace since the 1980s. Consumers must think differently about their finances during this inflationary environment,” said Paul Dilda, head of consumer strategy for BMO Harris Bank. “Seek advice from a financial expert on ways to successfully manage your personal finances, from learning ways to save and which types of accounts to use, to moving from knowing what you should do with your money, to actually doing it. By learning about what do to differently, and what not to change, during a period of inflation, consumers can maintain momentum toward their financial goals.”

Best practices to help Americans manage through the inflationary periods

Americans understand that planning and budgeting can help them better manage their finances and plan for increased costs. Compared to Q1 of 2022, the survey results show an increase in the percentage of Americans setting yearly budgets (39% vs. 42%) and having a written financial plan (33% to 37%), and meeting their financial advisors on a monthly basis (15% to 22%).

When asked who is most important in helping reach financial goals, 55% said their bankers were crucial (up 5 points from last quarter) and 52% said their investment company financial advisors were important (up 6 points from last quarter).

Despite inflation, Americans feel financially confident

Overall, the survey showed a slight increase in confidence levels from the last quarter (75% to 78%) which could be attributed to more and more Americans taking control of their personal finances, having a written financial plan, and checking in more often with their financial advisor.

BMO offers the following tips to keep up with the rising rates of inflation and to help Americans make financial progress during this time:

- Review and adjust your budget to account for the rising cost of everyday items.

- Assess your ongoing expenses such as streaming services, cable subscriptions, gym memberships or cell phone plans to negotiate lower prices or see if any of these can be reduced or eliminated.

- Postpone big-ticket purchases. Some price increases may be temporary, in which case it may be worthwhile to wait.

- Review monthly payments, such as the homeowners’ or auto insurance, to ensure it is appropriate and you are getting the most for your money.

- Speak with an expert to help ensure your savings and spending goals are still on track. If not, make adjustments.