BMO Real Financial Progress Index: Nearly two thirds of Americans are waiting on mortgage rates to drop before buying a home

The latest BMO Real Financial Progress Index reveals current mortgage rates are keeping many Americans from buying a home with 64 percent saying they are waiting on rates to drop before entering the market. Adding to the rate sensitivity of buyers, only 6 percent of Americans who say they plan to purchase a home soon plan on doing so this summer.

Compared to a year ago, homebuyers are dealing with much higher costs of ownership due to a combination of elevated mortgage rates, persistently high home prices and limited inventory, leaving housing affordability near the most challenging levels in more than three decades as a result of Federal Reserve rate hikes, according to BMO Economics.

BMO’s survey also found Americans’ perceptions of the economy has further affected their homebuying plans:

- Most are deferring plans to buy: 65 percent of those who do not own property say they are holding off buying a home due to the state of the economy with Asian Americans (68 percent) and Hispanics (70 percent) the most likely to make this decision. 43 percent reported they are no longer sure if or when they will buy.

- Majority of Americans not looking to buy in 2023: 6 percent of Americans who say they plan to buy a home soon will this summer and only 4 percent this fall. 32 percent say they plan to enter the market in 2024 or later if mortgage rates decline.

- Americans pause on refinancing: Among those planning to refinance their home, 81 percent say they are waiting until rates drop.

- Millennials and Gen Z feel the homebuying stress: More than half (56 percent) of those generations say they feel homebuying is more out of reach for them compared to when their parents were the same age.

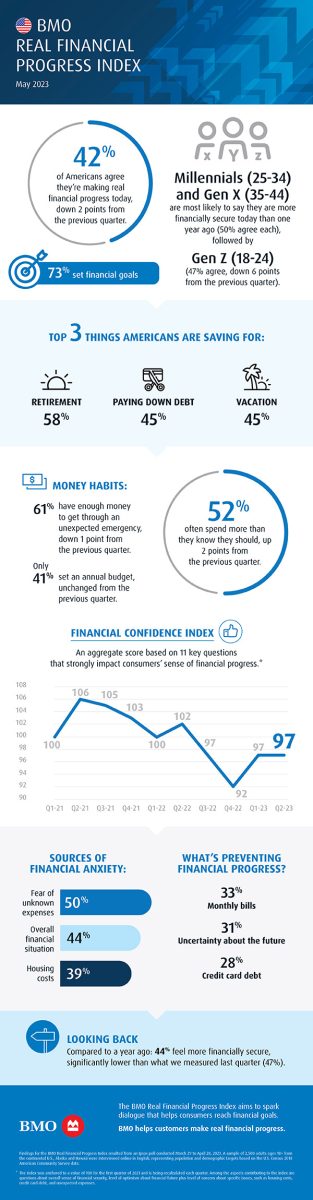

- Financial anxiety high overall: Housingcosts (68 percent) remain among the leading sources of financial anxiety for Americans. Other top sources of financial anxiety include concerns about their overall financial situation (82 percent) and fears of unknown expenses (83 percent).

“Homeownership has traditionally been one of the best ways to secure long-term financial gains, build equity and achieve real financial progress. At BMO, our goal is all about sustainable homeownership, so having a greater understanding of all the expenses that come along with owning and seriously thinking about your budget is integral to long term success.”

– Thomas Parrish

Head of U.S. Retail Lending Product Management, BMO

Americans report various sources of funding to pay for homes

The survey also highlights different financing strategies Americans intend to use for their home purchases:

- Loans from financial institutions: 68 percent of Americans plan on using loans from their financial institution and/or lines of credit to help finance their home purchase.

- Personal savings: 46 percent of Americans plan on using some of their personal savings to help pay for their home purchase, such as a down payment.

- Support from family or friends: 23 percent of Americans are expecting help including financial gifts and/or loans from family or friends.

“Most Americans understand how critical it is to establish a financial plan and our survey found three in four have set personal goals around money. Unfortunately, only 32 percent of Americans said they were meeting with their banker or financial advisor to help reach those goals. Regularly doing so will help ensure a secure plan and is imperative to reaching bigger financial aspirations, such as buying a home.”

– Paul Dilda

Head of U.S. Consumer Strategy, BMO

BMO offers the following tips to help Americans through their homebuying journey and make real financial progress:

- Get a single view of your finances, such as your bank’s digital banking app and tools.

- Understand what you have coming in, what you owe each month, how much you have saved up, and what you would still have in savings for the unexpected after making a down payment.

- Work with your banker who can develop a roadmap to achieve financial milestones such as saving up enough money for a down payment and closing costs.

- Pay down as much debt as possible and explore ways to increase your credit score as it will have an impact on preapproval, the mortgage rate you will receive, and how much house you can ultimately afford. By doing this, you will have a greater understanding of what you can pay each month, like your mortgage, taxes and insurance – along with everything else that comes along with homeownership such as maintenance.

- Understand what perks and resources your financial institution provides – that not only helps you develop a buying plan, but potentially save money in the long run as well.

- Speak with an expert to make sure your savings and payment patterns are on track to reach both near- and long-term goals and that you have the right financial tools in your toolbelt to achieve goals, such as buying a house or improving your credit score.