BMO Real Financial Progress Index: More than three-quarters of Americans want to improve financial literacy

The latest BMO Real Financial Progress Index revealed more than three-quarters of Americans (77 percent) wish they had greater financial literacy pertaining to core financial topics such as saving and investing, retirement, budgeting, credit scores, and home-buying. The figure is even higher for Black, Asian and Hispanic Americans with 86 percent reporting a desire for greater financial literacy compared to 72 percent of White Americans.

Additionally, Americans between the ages of 18 to 44 reported having the highest desire for more knowledge about financial topics. Younger millennials ages 25 to 34 reported having the highest desire (90 percent), followed by Gen Z ages 18 to 24 (89 percent), and finally older millennials and younger Gen X ages 35 to 44 (86 percent).

BMO’s Real Financial Progress Index also discovered that 53 percent of Americans reported having no conversations about budgeting, financial planning or similar topics while growing up. However, the study may indicate a dramatic shift in a positive direction with 66 percent of younger American ages 18 to 24 reporting that their family supported financial literacy compared to only 43 percent of Americans ages 45 to 54.

Recession and inflation concerns fueling budget changes

The overwhelming desire to improve financial literacy comes at a time when more than two-thirds (69 percent) of Americans report having made budget adjustments to address recession concerns. In fact, Hispanic Americans reported that concerns of a potential recession impacted financial goals more than any other group at 77 percent compared to 66 percent of White Americans.

Within the last three months, two-thirds (68 percent) of Americans reported that concerns about inflation have decreased, a significant decline from 76 percent in 2022. While Consumer Price Index (CPI) inflation has fallen sharply from four-decade highs of 9.1 percent last summer, it is 6 percent as of February and still squeezing family budgets, according to BMO Economics.

“It is crystal clear that Americans want to improve their financial literacy, which is crucial to increase confidence and the ability to make real financial progress. At BMO, we believe in zero barriers to financial literacy and progress, which is why we developed a free financial literacy resource online that is available to everyone to address key financial topics and Grow the Good in business and life by ensuring everyone has access to knowledge about how to manage money and create paths to progress.”

– Paul Dilda

Head of U.S. Consumer Strategy at BMO

BMO is helping Americans make progress on financial literacy

BMO’s financial literacy e-book in collaboration with United Way, launched in December 2022. The digital repository helps consumers make real financial progress through expert financial advice on budgeting, debt and credit management, digital banking, homeownership and more. It’s available to any American for free regardless of where they bank.

Despite expressing a strong need for financial literacy, 7 in 10 (72 percent) Americans said they have taken measures as an adult to improve their financial literacy with the top three actions being:

- Speaking with friends and family (29 percent)

- Reading books and watching programs about financial planning (27 percent)

- Working with a financial advisor (25 percent)

Additionally, more than a quarter of Americans review their financial plan monthly (30 percent) or check progress on their existing goals (28 percent).

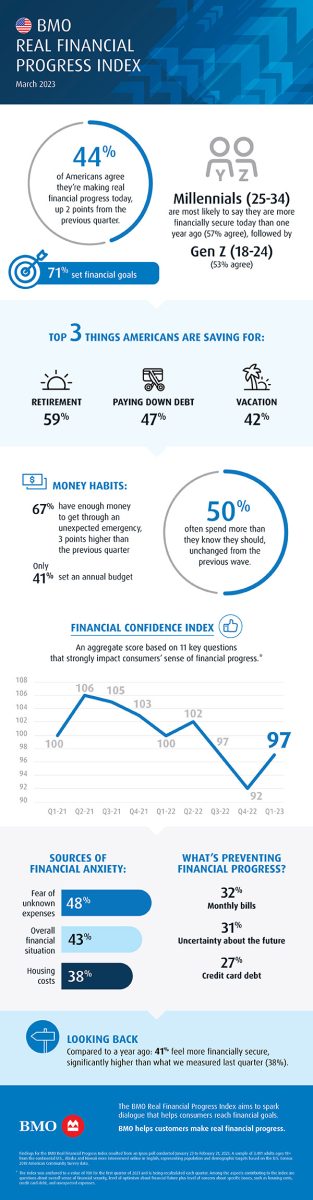

While financial confidence among Americans today remains below levels measured a year ago (72 percent very or somewhat confident compared to 75 percent in the first quarter of 2022), 44 percent of Americans said they are making real financial progress, and more than 8 in 10 (81 percent) report actively taking steps to improve their financial situation.

In addition to taking advantage of BMO’s Financial Literacy e-book, additional tips include:

- Use free digital banking tools and apps to help track spending patterns and save.

- Link your checking and savings accounts to have a clear view of what you are spending and saving. Be informed about incoming and outgoing money flow and have regular discussions to ensure you are making the financial progress needed to achieve your short, mid, and long-term goals.

- Establish and build credit and take advantage of credit-building solutions such as a credit building loan or secure card. Be sure to monitor your credit report score and activity often. Setting a up a savings goal and reoccurring savings transfers into an account, no matter the amount, provides a sense of progress and motivation to achieve your own savings goal.

- Make a budget or savings plan for large purchases like a car, vacation, or new appliance.

- When evaluating what you owe, pay down debt with the highest interest rate first.

- Assess ongoing expenses such as streaming services, cable and internet plans, gym memberships or phone providers and negotiate lower prices when possible or work to reduce or eliminate programs you don’t use often.

- Speak with an expert to make sure your savings and payment patterns are on track to reach both near- and long-term goals and that you have the right financial tools in your toolbelt to achieve goals, such as buying a house or car, or improving your credit score.

To learn more about how BMO can help customers make financial progress, visit: www.bmo.com/en-us/main/personal/.