BMO Real Financial Progress Index: Americans consider side hustles and investing amid rising financial anxiety

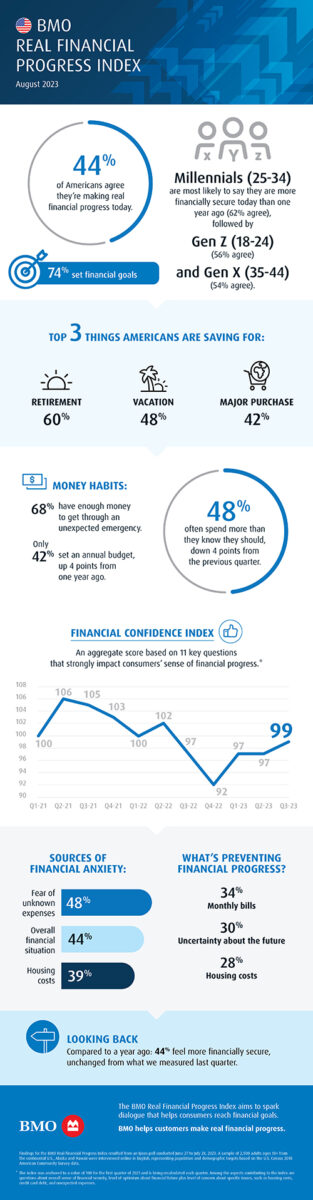

The latest BMO Real Financial Progress Index reveals that amid current economic conditions, such as inflation and rising interest rates, 4 out of 5 (80 percent) Americans say their financial situation is causing them financial anxiety with most (82 percent) interested in seeking advice on personal finance goals to improve their situation.

Top areas of interest where Americans want help growing and managing their money to achieve financial security include the following:

- Investing (43 percent)

- Side hustles (37 percent)

- Saving (27 percent)

- Budgeting (25 percent)

- Debt management (25 percent)

Additionally, with most Americans (80 percent) saying their financial situation is causing anxiety, the top factors driving concerns are:

- Fear of unknown expenses (83 percent)

- Housing costs (67 percent)

- Family-related expenses (68 percent)

- Medical expenses (62 percent)

- Credit card debt (51 percent)

In fact, year-over-year, more Americans say their concerns over housing costs, credit card debt, and keeping up with monthly bills and are preventing them from making real financial progress. Additionally, 43 percent of Americans say they do not earn enough money to put anything into savings after paying expenses.

“Given the current economic climate, it’s clear people want to take action to become more financially secure – even going so far as to think about additional sources of income. Ultimately, what these findings show is that Americans want additional financial advice and resources to help with money management. With increasing costs proving challenging for many, it’s important that Americans know there are free resources available to help make financial progress – even in uncertain periods – such as meeting with your banker to create a budget and help build a personalized plan to make the most of their money that also address the various sources of income a person may have.”

– Paul Dilda

Head of Consumer Strategy at BMO

As elevated inflation continues, nearly half of Americans aren’t making financial progress

With the current inflation surge now stretching past two years, nearly half (46 percent) of Americans say they are not making financial progress. Out of those who are not making progress, 36 percent said they are not getting ahead with their savings or goals. Additionally, 66 percent say they have no written financial plan.

According to BMO Economics, the U.S. inflation rate has accelerated to 3.3 percent in July with the Fed target range for interest rates hovering between 5.25 to 5.5 percent. Additionally, home prices for the country’s 20 largest cities climbed 0.9 percent in June, the fourth straight monthly gain.

“U.S. consumer confidence fell more than expected in August amid still-elevated food and gas prices, softening labor market conditions and economic uncertainty. Despite this and after several Fed rate hikes, the economy is still growing – 2 percent in the most recent quarter – and consumer price inflation has come down nicely from last summer’s 40-year high of 9.1 percent to just above 3 percent. Looking forward, the Federal Reserve has made it clear that a 2 percent inflation rate target is still the goal, but that we have a long way to go.”

– Michael Gregory

Deputy Chief Economist and Head of U.S. Economics at BMO

Americans rely on bankers, financial advisors, and digital banking apps to make financial progress

The Index also found that more Americans are relying on their banker or financial advisor today to reach their financial goals compared to a year ago – 53 percent compared to 49 percent in 2022.

Americans also say they have a strong preference for digital banking apps that provide useful resources, with 7 in 10 (70 percent) saying the tips and tools in their digital banking app help them make real financial progress. 54 percent of Americans have seen improvement in their financial progress since using their digital banking app, and nearly half (49 percent) say they have set specific financial goals through their digital banking platform.

“These BMO Real Financial Progress Index findings reinforce the fact that customers want leading digital experiences that help them do more with their money. BMO is committed to meeting our customers’ evolving needs and expectations with the digital tools they need. At BMO, we blend both human and digital experiences that offer professional financial advice on digital banking, budgeting, debt management and more.”

– Mat Mehrotra

Chief Digital Officer at BMO

Check out the full press release to learn more: U.S./Canada