BMO Harris Bank Funds $5.1 Billion in Paycheck Protection Program Loans to 20,000 Businesses

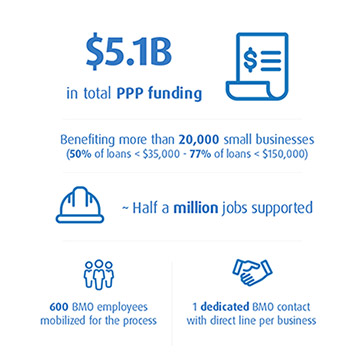

BMO Harris Bank has secured $5.1 billion in total funding for more than 20,000 borrowers to date through the Small Business Administration’s Paycheck Protection Program (PPP).

The loans approved by BMO represent a wide range of clients:

- Half of the loans were for $35,000 or less

- 78 percent of the loans were for less than $150,000

- 23 percent of loans, totaling $1.2 billion in funding, went to borrowers in low or moderate income areas

- In total, the loans have the potential to support nearly 500,000 jobs

“Businesses need access to capital more than ever, and it’s our responsibility to help them keep commerce flowing,” said David Casper, U.S. CEO, BMO Financial Group. “It’s been our goal to secure funding for as many businesses as possible and to ensure every client received personalized service. We mobilized over 600 BMO employees to ensure that every PPP loan application was handled by a dedicated BMO employee, and every business client had a direct contact number.”

BMO employees from across the organization came together to process PPP loan applications since the first round of funding was approved by Congress as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

BMO continues to process PPP loan applications until program funds are exhausted.

The bank also added new crisis-related resources to BMO’s online resource hub to help business clients navigate challenges brought on by the COVID-19 pandemic. The hub contains financial guidance and tools tailored for business owners, including information on emergency financing that supports business continuity, workbooks and calculators to help pivot operations, advice on sourcing alternate suppliers and best practices for supporting employee health and remote work needs. To access BMO’s resource hub, visit BMOHarris.com/businessinsights.

The latest information, including relief program resources and the status of branch operations, can be found on the bank’s COVID-19 webpage.